Turquoise Health, a private health care price transparency company, recently released their second

Price Transparency Impact Report. Turquoise reports that they have downloaded machine readable files (MRF) from almost 5,400 hospitals as of the end of Q1 2023.

Turquoise Health is one of the leading organizations in utilizing the data made available by the CMS price transparency rule. Their credibility has been on display multiple times over the past year as they have testified in front of various federal and state committees on price transparency. In addition to that, Turquoise’s latest report includes over 5,000 hospitals’ machine-readable files and 810 million negotiated rates published by healthcare organizations, with payer data representing all sites of service and over 95% of the country’s commercially insured lives. Notably, its methodology (detailed in

an October blog post) has led to higher compliance totals than those reported by other watchdog groups that use much older data and rely on minimal sampling techniques.

Turquoise, through their downloading of the MRFs, provides a publicly available scorecard on the completeness of each hospital’s file. According to their impact report, for acute care hospitals across the country, the average completeness score of an acute care hospital’s MRF is 4.26 stars out of 5. In Wisconsin, using the scores from the Turquoise website, the average Wisconsin acute care hospital score is 4.51 stars out of 5.

The report also comments that there are some much needed improvements in the CMS rule as it lacks standards that make compliance more difficult for hospitals and data usability more difficult for data organizations like Turquoise. These comments are consistent with another report issued by the Kaiser Family Foundation who said many of the problems with price transparency are the result of a rule which lacks specificity and uniformity. CMS also agrees that more standardization would help hospitals comply and is seeking additional clarity and enforcement guidance from Congress.

Despite those challenges created by a problematic CMS rule, a pandemic and severe workforce shortages, Wisconsin hospitals have been complying and Turquoise is able to use the MRFs to create a public facing price tool that includes hospital specific cash price and insurance company negotiated rates by procedure.

In addition, according to the report, another key milestone for the price transparency movement is the increasing number of startups and innovators flocking to this space. Turquoise said the past year has seen “a wave of venture funding flow into the early-stage market for price transparency,” and specifically called out Milu Health (proactive health spend savings for patients and employers), Certainly Health (consumer-facing booking with set prices) and Finestra Health (crowdsourced price transparency data from patient bills) as its competitors of note.

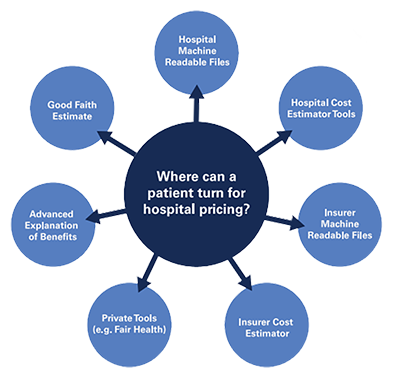

But price transparency is more than just posting MRFs. Hospitals and health systems are working to comply with both state and federal price transparency policies, which include the federal Hospital Price Transparency Rule and provisions in the No Surprises Act. The Centers for Medicare & Medicaid Services (CMS) found that in 2022, 70% of hospitals complied with both components of the Hospital Price Transparency Rule, including the consumer-friendly display of shoppable services information, as well as the machine-readable file requirements. This is an increase from 27% in 2021. Moreover, when looking at each individual component of the Rule, 82% of hospitals met the consumer-friendly display of shoppable services information requirement in 2022 (up from 66% in 2021) and 82% met the machine-readable file requirement (up from 30% in 2021). These numbers show significant progress on the part of hospitals in implementing these requirements.

What all this means is that consumers have more price transparency than ever before, and Wisconsin hospitals and health systems are helping lead the way.