Vol. 66, Issue 33

View more issues of The Valued Voice

Sign Up for WHA's Newsletter

Click here to view past issues

IN THIS ISSUE

- WHA Weighs in on Board of Nursing Proposal to Eliminate Licensure Step

- President Biden Signs Legislation Extending Enhanced ACA Subsidies

- Grassroots Spotlight: WHA Discusses Regulatory, Insurer Burden with Rep. Gallagher Staff

- GUEST COLUMN: Could Student Loan Repayment be a Deciding Advantage for Health Care Employers?

EDUCATION EVENTS

Aug. 8, 2025

WHA Financial WorkshopSep. 17, 2025

2025 Annual Wisconsin Organization of Nurse Leaders ConferenceJan. 28, 2026

2026 WHA Health Care Leadership AcademyClick here to view education event calendar

View more issues of The Valued Voice

Sign Up for WHA's Newsletter

Thursday, August 18, 2022

Although employers have been matching dollars to retirement accounts for 40 years, employees are still not saving enough for retirement. Many claim they aren’t saving enough because they can’t afford to. Simply put—due to the high level of student debt in America, and especially in the health care industry, workers are often asked to make a choice: retirement savings or student loan payments.

Although employers have been matching dollars to retirement accounts for 40 years, employees are still not saving enough for retirement. Many claim they aren’t saving enough because they can’t afford to. Simply put—due to the high level of student debt in America, and especially in the health care industry, workers are often asked to make a choice: retirement savings or student loan payments.

According to Forbes there is a mountain of student debt (roughly $1.7 trillion allocated to 45 million borrowers), and it is negatively impacting your employees.

The impact of student loan debt on employees

According to a survey by American Student Assistance:

Both employers and employees can benefit greatly from a program that helps pay down student debt faster.

Health care industry graduates:

Today’s young employees aren’t wooed by traditional approaches. Employees are looking to employers who offer new and innovative employee benefits, and have a financial interest in retaining their best employees. Gallup estimates that turnover is costing the U.S. economy over $30.5 billion annually

Those employers who are looking for a competitive advantage in recruiting and retaining employees can take advantage of an easy-to-administer student loan repayment benefit program that can address the financial stressors of employees.

Is student loan repayment a realistic benefit for health care employers?

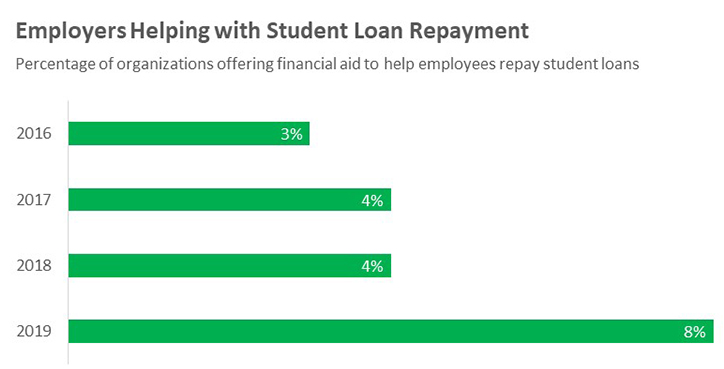

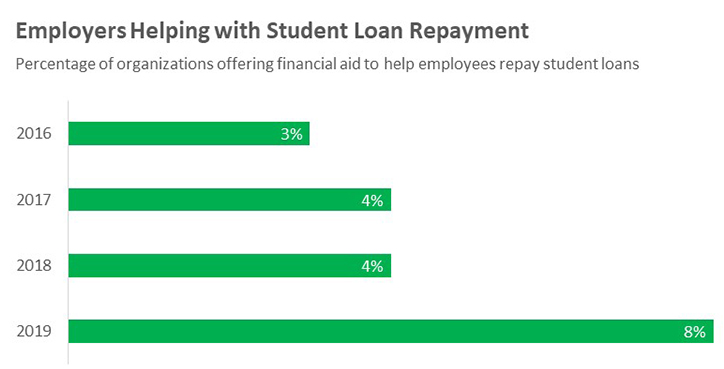

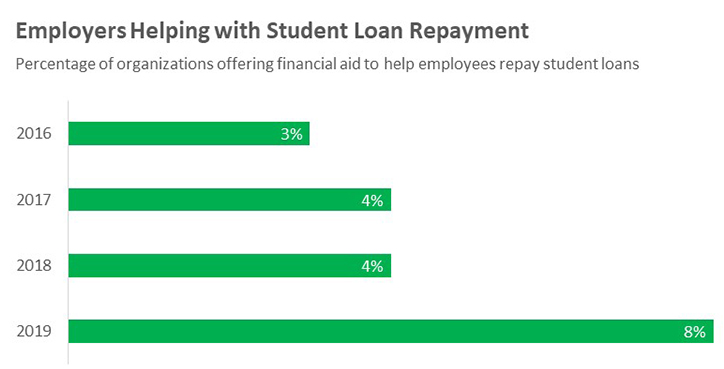

Employees are looking to employers for new and innovative employee benefits. The graphic below created by the Society for Human Resource Management shows that the number of employers who are helping with student loan repayment is only increasing. By 2023, is it estimated that 34% of companies will offer student loan assistance, according to Thrive.

Health care employers who are looking for an innovative way to attract and retain talent in their industry can look to these numbers and see the trend—employers are responding to the needs of the workforce, and the top innovators are getting on board.

Could student loan repayment be the deciding advantage in health care?

In a recent survey conducted by Laurel Road, 58% of millennials would trade an additional vacation day for a student loan repayment assistance, showing how valuable customized, meaningful benefits are to this generation.

And, when it comes to retention, student loan repayment seems to be just as powerful. Eighty-six percent of employees said they would commit to their employer for five years if they helped with student loans, according to a survey by American Student Assistance.

A well-run student loan assistance program allows your health care organization to provide an eye-catching benefit that is budget neutral by simply allowing employees to allocate existing retirement plan matching dollars without an additional cost.

Let us show you how to take advantage of already budgeted (but unused) dollars to offer a uniquely designed solution for your employees that gives them better choices. M3 Financial can work with health care organizations to offer solutions that:

GUEST COLUMN: Could Student Loan Repayment be a Deciding Advantage for Health Care Employers?

According to Forbes there is a mountain of student debt (roughly $1.7 trillion allocated to 45 million borrowers), and it is negatively impacting your employees.

The impact of student loan debt on employees

According to a survey by American Student Assistance:

- 56% of employees worry about repaying their loans either all the time or often

- 40% report that worrying about their student loans has impacted their health

- 55% would like to go to grad school, but couldn’t take on any additional student loans

- 61% have considered getting a second job to help pay off their student loans

Both employers and employees can benefit greatly from a program that helps pay down student debt faster.

Health care industry graduates:

- Carry an increasing load of student debt

- Are foregoing major life decisions like marriage, home ownership, etc.

- Have less financial stability

Today’s young employees aren’t wooed by traditional approaches. Employees are looking to employers who offer new and innovative employee benefits, and have a financial interest in retaining their best employees. Gallup estimates that turnover is costing the U.S. economy over $30.5 billion annually

Those employers who are looking for a competitive advantage in recruiting and retaining employees can take advantage of an easy-to-administer student loan repayment benefit program that can address the financial stressors of employees.

Is student loan repayment a realistic benefit for health care employers?

Employees are looking to employers for new and innovative employee benefits. The graphic below created by the Society for Human Resource Management shows that the number of employers who are helping with student loan repayment is only increasing. By 2023, is it estimated that 34% of companies will offer student loan assistance, according to Thrive.

Health care employers who are looking for an innovative way to attract and retain talent in their industry can look to these numbers and see the trend—employers are responding to the needs of the workforce, and the top innovators are getting on board.

Could student loan repayment be the deciding advantage in health care?

In a recent survey conducted by Laurel Road, 58% of millennials would trade an additional vacation day for a student loan repayment assistance, showing how valuable customized, meaningful benefits are to this generation.

And, when it comes to retention, student loan repayment seems to be just as powerful. Eighty-six percent of employees said they would commit to their employer for five years if they helped with student loans, according to a survey by American Student Assistance.

- 46% of employees would rather have student repayment loan assistance than a 401(k)/403(b) match, according to The Business Wire

- And only 8% of your competitors are offering this type of plan (Society for Human Resource Management)

- $1 contributed to a Student Debt program can return $1.66 to employees (BenefitEd)

A well-run student loan assistance program allows your health care organization to provide an eye-catching benefit that is budget neutral by simply allowing employees to allocate existing retirement plan matching dollars without an additional cost.

Let us show you how to take advantage of already budgeted (but unused) dollars to offer a uniquely designed solution for your employees that gives them better choices. M3 Financial can work with health care organizations to offer solutions that:

- Allow employers to offer a student loan program without creating another budget Item

- Give employees a choice not a sacrifice

- Will not require any changes to plan documents

- Give employees access to the $24.5 billion per year in retirement matching dollars that is left on the table annually by employees (Thrive)

Vol. 66, Issue 33

Thursday, August 18, 2022

GUEST COLUMN: Could Student Loan Repayment be a Deciding Advantage for Health Care Employers?

According to Forbes there is a mountain of student debt (roughly $1.7 trillion allocated to 45 million borrowers), and it is negatively impacting your employees.

The impact of student loan debt on employees

According to a survey by American Student Assistance:

- 56% of employees worry about repaying their loans either all the time or often

- 40% report that worrying about their student loans has impacted their health

- 55% would like to go to grad school, but couldn’t take on any additional student loans

- 61% have considered getting a second job to help pay off their student loans

Both employers and employees can benefit greatly from a program that helps pay down student debt faster.

Health care industry graduates:

- Carry an increasing load of student debt

- Are foregoing major life decisions like marriage, home ownership, etc.

- Have less financial stability

Today’s young employees aren’t wooed by traditional approaches. Employees are looking to employers who offer new and innovative employee benefits, and have a financial interest in retaining their best employees. Gallup estimates that turnover is costing the U.S. economy over $30.5 billion annually

Those employers who are looking for a competitive advantage in recruiting and retaining employees can take advantage of an easy-to-administer student loan repayment benefit program that can address the financial stressors of employees.

Is student loan repayment a realistic benefit for health care employers?

Employees are looking to employers for new and innovative employee benefits. The graphic below created by the Society for Human Resource Management shows that the number of employers who are helping with student loan repayment is only increasing. By 2023, is it estimated that 34% of companies will offer student loan assistance, according to Thrive.

Health care employers who are looking for an innovative way to attract and retain talent in their industry can look to these numbers and see the trend—employers are responding to the needs of the workforce, and the top innovators are getting on board.

Could student loan repayment be the deciding advantage in health care?

In a recent survey conducted by Laurel Road, 58% of millennials would trade an additional vacation day for a student loan repayment assistance, showing how valuable customized, meaningful benefits are to this generation.

And, when it comes to retention, student loan repayment seems to be just as powerful. Eighty-six percent of employees said they would commit to their employer for five years if they helped with student loans, according to a survey by American Student Assistance.

- 46% of employees would rather have student repayment loan assistance than a 401(k)/403(b) match, according to The Business Wire

- And only 8% of your competitors are offering this type of plan (Society for Human Resource Management)

- $1 contributed to a Student Debt program can return $1.66 to employees (BenefitEd)

A well-run student loan assistance program allows your health care organization to provide an eye-catching benefit that is budget neutral by simply allowing employees to allocate existing retirement plan matching dollars without an additional cost.

Let us show you how to take advantage of already budgeted (but unused) dollars to offer a uniquely designed solution for your employees that gives them better choices. M3 Financial can work with health care organizations to offer solutions that:

- Allow employers to offer a student loan program without creating another budget Item

- Give employees a choice not a sacrifice

- Will not require any changes to plan documents

- Give employees access to the $24.5 billion per year in retirement matching dollars that is left on the table annually by employees (Thrive)

IN THIS ISSUE

- WHA Weighs in on Board of Nursing Proposal to Eliminate Licensure Step

- President Biden Signs Legislation Extending Enhanced ACA Subsidies

- Grassroots Spotlight: WHA Discusses Regulatory, Insurer Burden with Rep. Gallagher Staff

- GUEST COLUMN: Could Student Loan Repayment be a Deciding Advantage for Health Care Employers?