Medicaid

WHA has advocated for a Medicaid program that preserves access to care for our most vulnerable citizens, is a "true safety net" for those with no other options, and adequately compensates providers.

WI Hospital Medicaid Reimbursement Lags the Nation

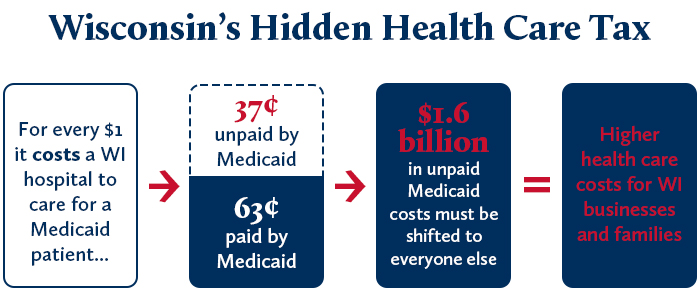

The Medicaid (Badger Care) program is an essential health care program in Wisconsin, providing coverage for nearly 1.2 million individuals or about 20% of the state’s population. The Medicaid program’s hospital reimbursement rates result in below-cost reimbursement and Medicaid shortfalls for Wisconsin hospitals and health systems and a “Hidden Health Care Tax” on Wisconsin businesses and families because of cost-shifting from government payers.

To offset cost-shifting of these unpaid costs from the Medicaid program, Wisconsin created the Medicaid Disproportionate Share Hospital (DSH) program. Wisconsin’s “Hidden Health Care Tax” is now $1.6 billion, a nearly $758 million larger shortfall since DSH was created in 2013.

Wisconsin hospitals are the health care system’s “safety net,” serving all who come through their doors regardless of payment source – including 1.2 million patients on Medicaid. Hospitals across the U.S. were reimbursed 88% of the cost of providing care to Medicaid patients. In Wisconsin, reimbursement only covers 63% of cost, 25% less than the national average.

Wisconsin’s Medicaid reimbursement resulted in $1.6 billion in unpaid costs in 2023. These unpaid costs are shifted to Wisconsin businesses – a situation known as Wisconsin’s “Hidden Health Care Tax” – which drives up health insurance premiums for everyone else. This tax is greater than the cost of Wisconsin’s motor vehicle fuel tax, corporate income tax, utility tax and what businesses pay for unemployment insurance.

Relevant Videos